Assexmarkets Review: Is Assexmarkets Legit?

Assexmarkets Review 2025 shows a WikiFX score of 1.23/10, flagged for no valid regulation and risky operations.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Vault Markets is an online forex broker that claims itself an award-winning broker. Its website looks very uninformative.

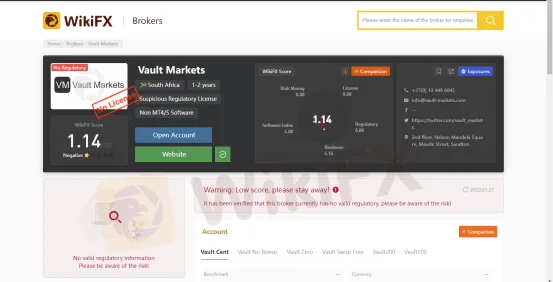

What Vault Markets is

Vault Markets is an online forex broker that claims itself an award-winning broker. Its website looks very uninformative. Based on its website, it is hard to find a specific column about the introduction of this company. There is also no information about who owns and runs this company Although we know Vault Markets was established in 2021, we can not find the date when Vault Markets was established on its website. According to WikiFX, this broker has been given by WikiFX a very low rating of 1.14/10. It currently does not have a legitimate license, which means Vault Markets isnt regulated by any regulatory institution. Be aware of the risk as they may take your money away fraudulently.

Suspicious scam behavior

Vault Markets has a bad track record of taking traders‘ money away. WikiFX has received a complaint of a trader who comes from South Africa. Based on the complaint, the trader can not make withdrawals from his/her account. After his/her deposit, the trader found that the losses were higher than the profits, The trading chart showed a profit but the trader’s balance remained negative. This trader contacted Vault Market, but 2 weeks passed, there was still no response from the broker. Since Vault Markets is unregulated, it is difficult to hold it accountable for the loss of money.

How the risk looks like

Tempting enough as its offer seems to look, Vault Markets tries its best to persuade clients to invest with them. On its website, Vault Markets claims “ the more you refer, the more you received.” This means the traders have the opportunity to earn extra income not only when they trade but also when they refer a friend or fellow trader. Vault Markets offer trades with up to 10% of the deposits back into traders accounts. For example, if you refer a client who deposits R 10,000 you will earn up to 10% of their first-time deposit over and above when they trade. Accordingly, Vault Markets are likely to give you some baits to make you believe that there are a lot of potential returns as long as you invest in them. Once you deposit, your money probably go shores where it disappears, so you will have almost no charge back option left. Once the trap becomes so obvious, they will stop responding to you and your funds are no longer under your control.

Conclusion

Overall, Vault Markets is not a good option for you to invest in as it is an unregulated broker that has a bad track record of endangering traders money. We recommend you do more research and find a better alternative before you make a decision.

WikiFX contains details of more than 31,000 global forex brokers, which gives you a huge advantage while seeking the best forex brokers. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link below (https://www.wikifx.com/en/download.html). Running well in both the Android system and IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Assexmarkets Review 2025 shows a WikiFX score of 1.23/10, flagged for no valid regulation and risky operations.

RaiseFX Review reveals low WikiFX score, hidden withdrawal fees, and serious doubts about its trustworthiness.

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.