TABLE OF CONTENTS:

Easy guide to trading the Quasimodo Pattern

The Quasimodo Pattern or Over and Under pattern is a relatively new entrant to the field of technical analysis in the financial markets. Although new, the Quasimodo pattern is a commonly occurring theme that is more frequent when price carves a top or a bottom or when price begins a major correction to the trend.

The Quasimodo Pattern, although complex as it might seem is actually very simple. This trading pattern is especially powerful because when it occurs, in most cases, traders will notice a confluence with other methods of analysis.

For example, when a trader spots a Quasimodo pattern near a support or resistance level, it increases the confidence of the trader or the trading probability. Likewise, when trading divergences, when you spot a Quasimodo pattern, that confluence can be used to trade the divergence set up with more confidence.

As we can see from the above, the Quasimodo pattern is not a trading strategy by itself but is more of a confluence pattern that can be used to confirm a trader‘s bias. Of course, the Quasimodo pattern doesn’t appear all the time, but when it does, traders can be sure that the market offers a high probability trade set up.

What is the Quasimodo (Over and Under) Pattern?

A Quasimodo Pattern is simply a series of Highs/Lows and Higher or Lower highs or lows.

Quasimodo Short Signal Pattern

There should be a prior uptrend in the markets

Price makes a new high, declines and makes a new local low

Price then rallies above the previous high to mark a new higher high

Price then falls to form a new lower low

Price then rises towards the initial high (but does not make a new higher high).

The fifth level in the set up is the trigger, where a short position is taken. Stops are set above the higher high and the take profit level is up to the trader.

Quasimodo Long Signal Pattern

There should be a prior downtrend in the markets

Price makes new low then makes a small rally and forms a local high

Price then declines to form a new lower low taking out the previous low

Price then rallies to make a new higher high and then declines

The final decline is equal to the first low

The fifth leg in this pattern is the trigger for long positions with stops set to at or below the lower low

Quasimodo Long Signal Pattern Examples:

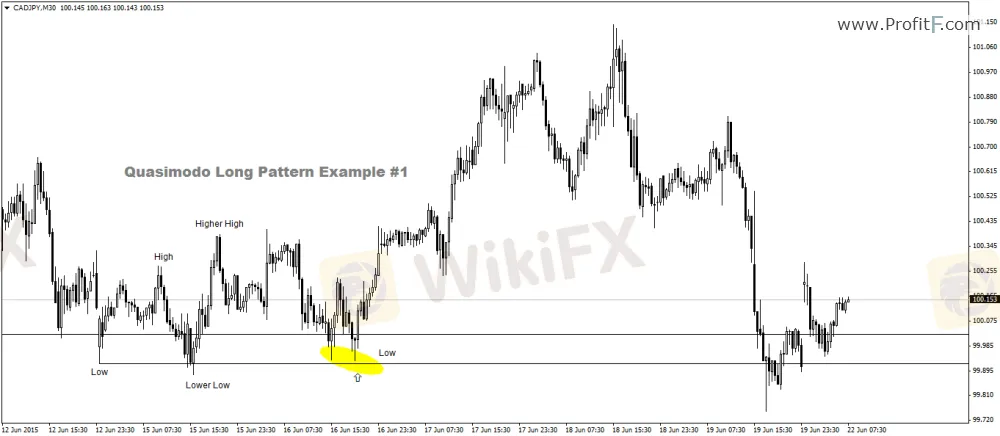

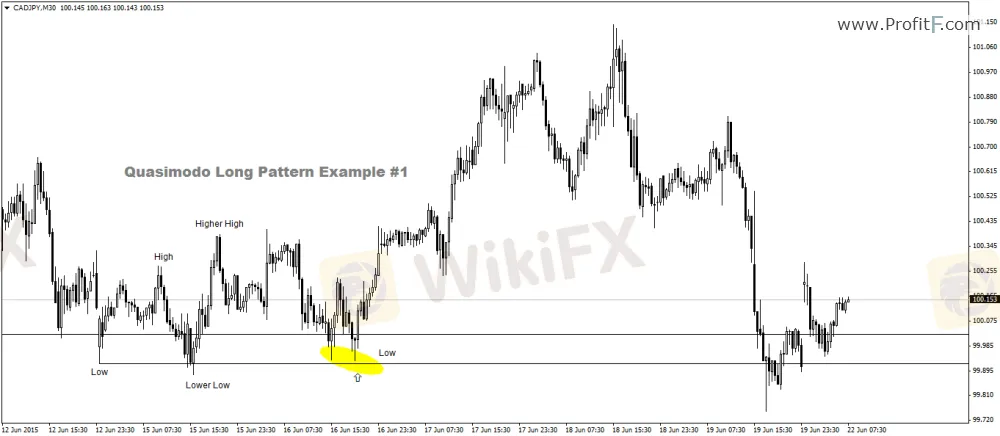

Quasimodo Long Example #1

Price is in a downtrend

Price then makes a new low at 99.923 and then makes a new local high at 100.274

Price then declines and makes a new lower low at 99.983

Price then rallies to make a new higher high at 100.38 and then declines

The final leg in the decline is just a few pips above the previous low. This triggers a long signal

Here is another example of the Quasimodo Long example:

Quasimodo Long Example #2

Quasimodo Short Signal Pattern Examples:

Quasimodo Short Example #1

Price is in an uptrend

Price then makes a new high at 1.5251 and then declines to make a low at 1.5187

Price then rallies to make a higher high at 1.5321 and then declines

A new lower low is posted at 1.5165

Price then makes a modest rally and this high stalls a few pips close to/above the previous high

A short entry is then taken with stops near the highest high

There is also an additional confirmation yet again with the RSI divergence as well

Another example of the Quasimodo Short pattern example is given below:

Quasimodo Short Example #2

Conclusion:As we can see from the above, the Quasimodo or Over and Under pattern is a relatively simple pattern, which when used in conjunction with other trading strategies or signals offers a great way to increase the probability of a trade set up.

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC